Summary of GST notifications under Central Tax (Rate) dated 8 October 2024 for changes in GST Rates, exemptions and RCM

On October 8, 2024, the Ministry of Finance issued a series of important notifications amending various tax rates under the Central Goods and Services Tax (CGST) regime. These amendments address several key areas, exemption, RCM, including changes to tax rates for services and goods that were originally specified in notifications issued in 2017. The changes reflect the government’s effort to streamline the tax structure and ensure alignment with evolving business and industry needs.

| Number | Date | Subject | Download |

|---|---|---|---|

| 09/2024-Central Tax (Rate) | 08-Oct-2024 | Seeks to amend Notification No 13/2017-Central Tax (Rate) dated 28.06.2017 | English हिन्दी |

| 08/2024-Central Tax (Rate) | 08-Oct-2024 | Seeks to amend Notification No 12/2017-Central Tax (Rate) dated 28.06.2017 | English हिन्दी |

| 07/2024-Central Tax (Rate) | 08-Oct-2024 | Seeks to amend Notification No 11/2017-Central Tax (Rate) dated 28.06.2017 | English हिन्दी |

| 06/2024-Central Tax (Rate) | 08-Oct-2024 | Seeks to amend Notification No. 4/2017- Central Tax (Rate) dated 28.06.2017.. | English हिन्दी |

| 05/2024-Central Tax (Rate) | 08-Oct-2024 | Seeks to amend Notification No. 1/2017- Central Tax (Rate) dated 28.06.2017. | English हिन्दी |

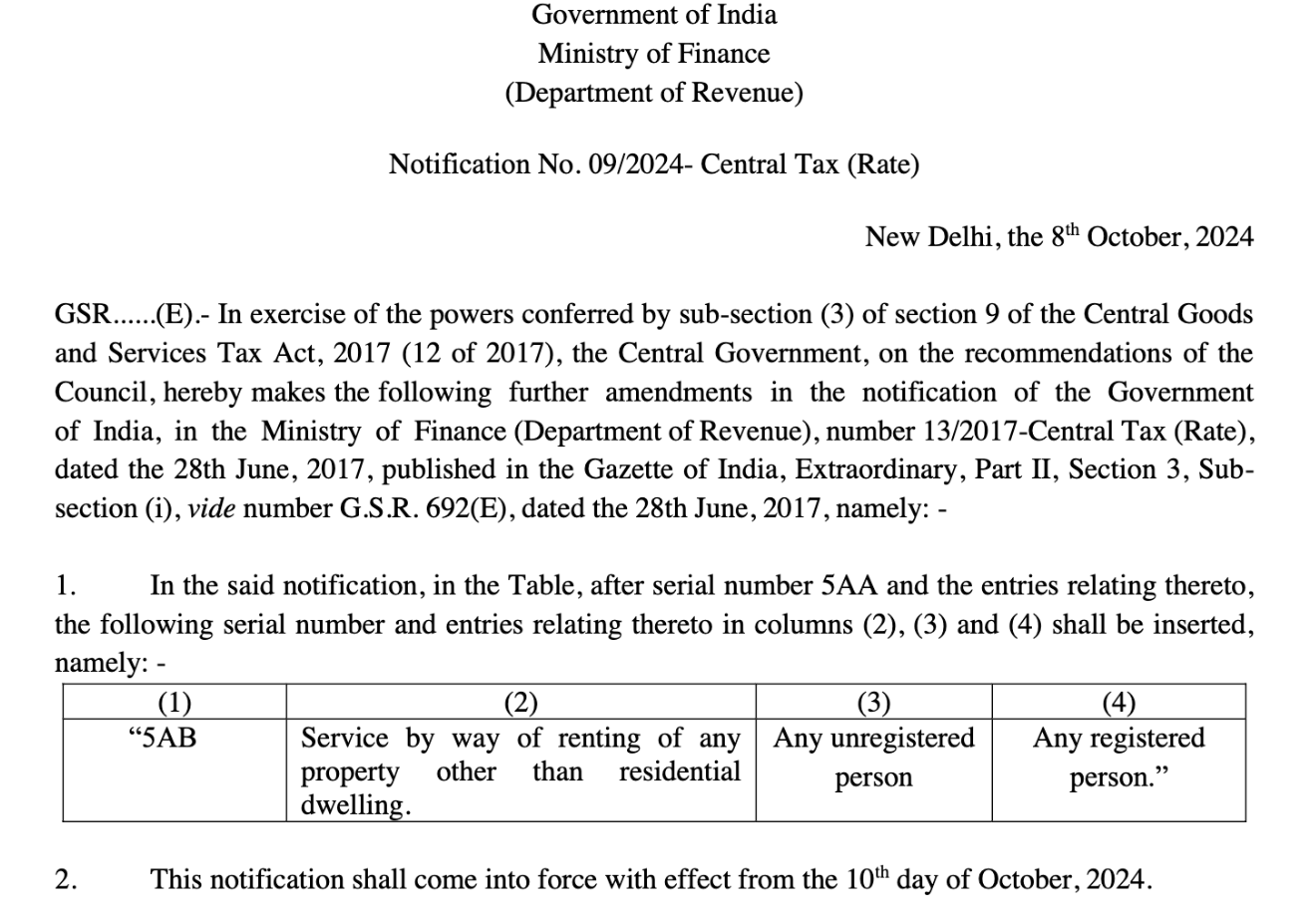

Notification No. 09/2024-Central Tax (Rate)

Subject: Seeks to amend Notification No 13/2017-Central Tax (Rate) dated 28.06.2017

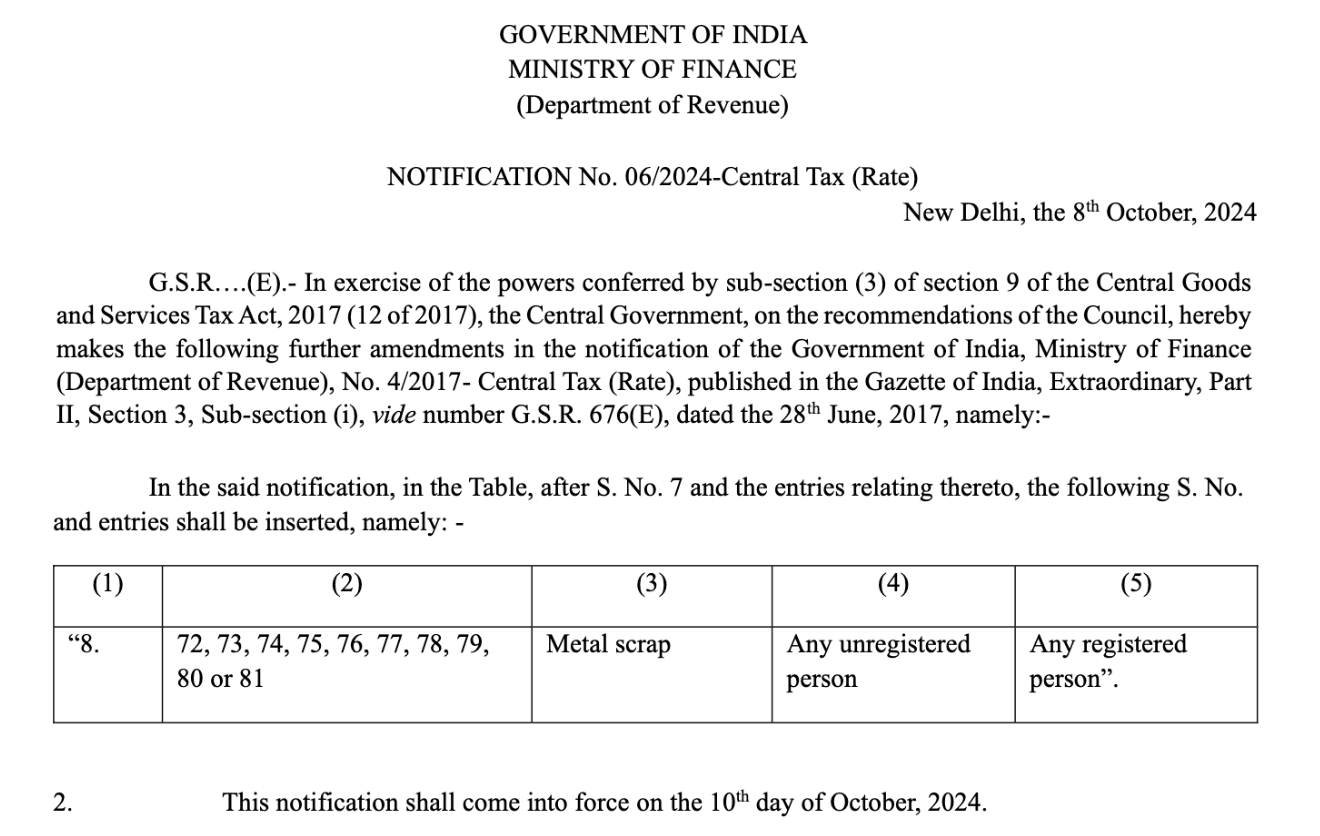

Notification No. 06/2024-Central Tax (Rate)

Subject: Seeks to amend Notification No. 4/2017-Central Tax (Rate) dated 28.06.2017

2. Notification No. 08/2024-Central Tax (Rate)

Subject: Seeks to amend Notification No 12/2017-Central Tax (Rate) dated 28.06.2017

Details:

- This notification amends Notification No. 12/2017, which originally provided GST exemptions on certain goods and services.

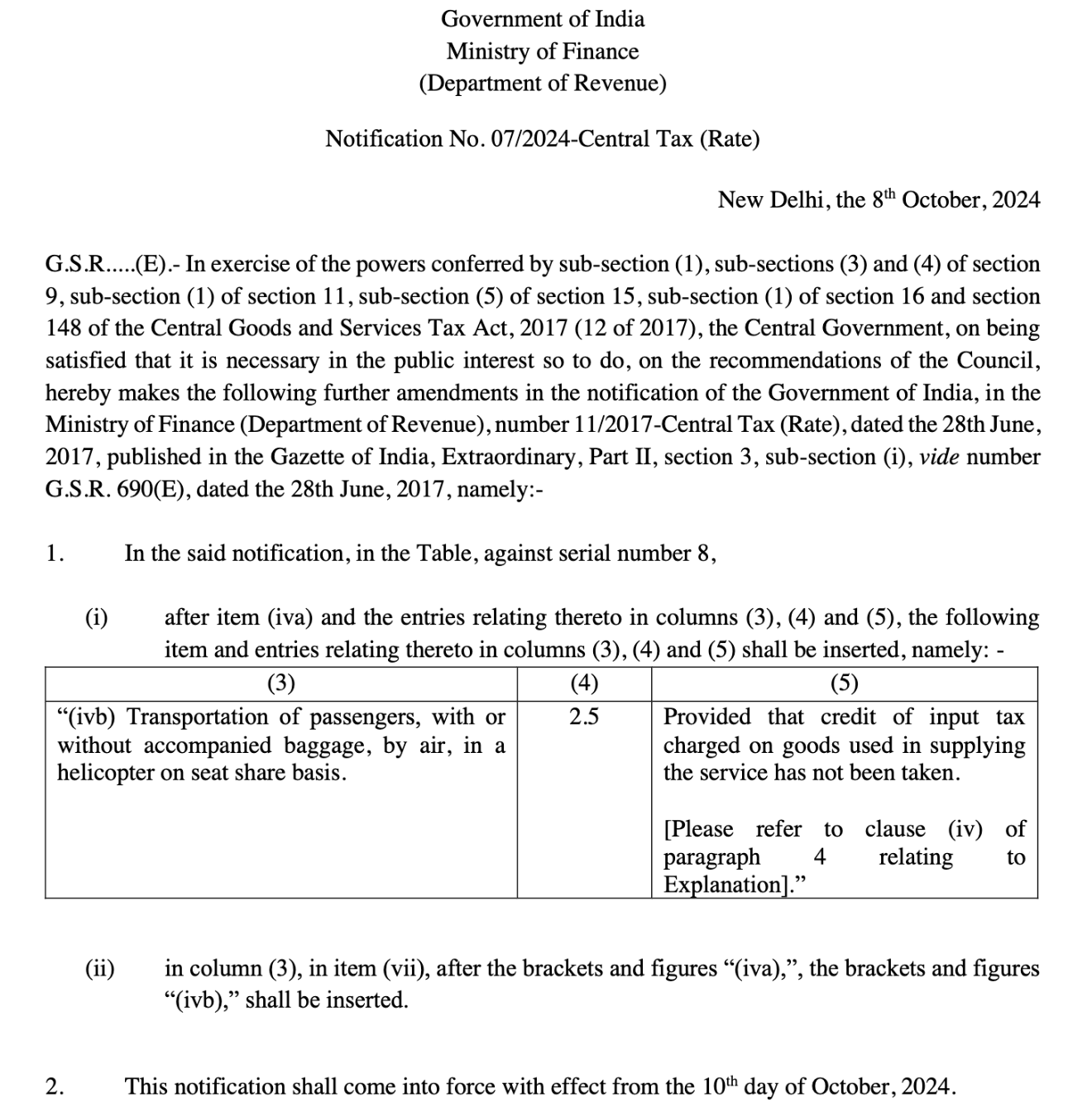

3. Notification No. 07/2024-Central Tax (Rate)

Subject: Seeks to amend Notification No 11/2017-Central Tax (Rate) dated 28.06.2017

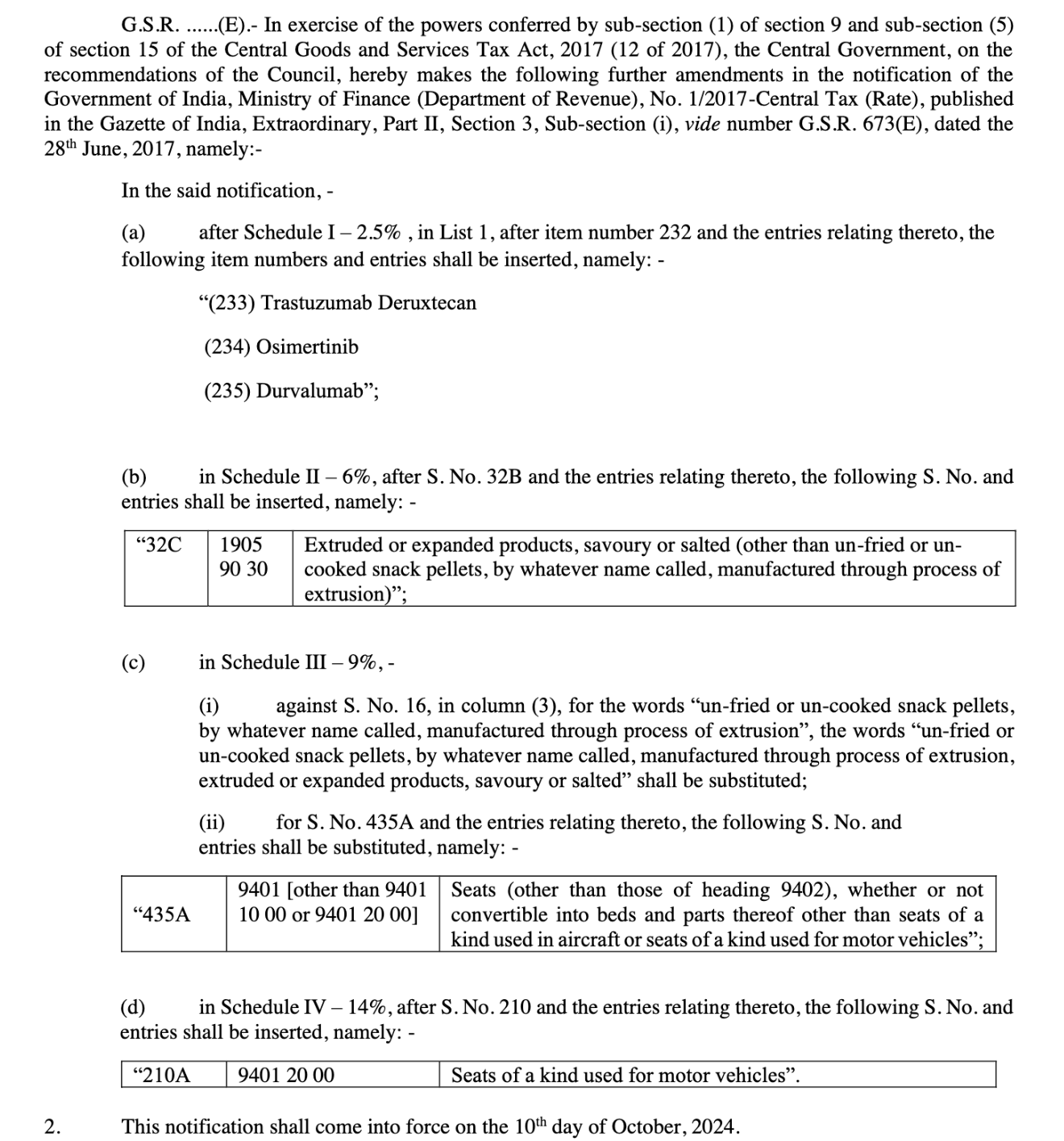

5. Notification No. 05/2024-Central Tax (Rate)

Subject: Seeks to amend Notification No. 1/2017-Central Tax (Rate) dated 28.06.2017

Visit www.cagurujiclasses.com for practical courses

Disclaimer:-

The opinions presented are exclusively those of the author and CA Guruji Classes. The material in this piece is intended purely for informational purposes and for individual, non-commercial consumption. It does not constitute expert guidance or an endorsement by any organization. The author, the organization, and its associates are not liable for any form of loss or harm resulting from the information in this article, nor for any decisions made based on it. Furthermore, no segment of this article or newsletter should be employed for any intention unless granted in written form, and we maintain the legal right to address any unauthorized utilization of our article or newsletter.