New TDS Rules for Scrap Dealers: Important Advisory for October-November Filing

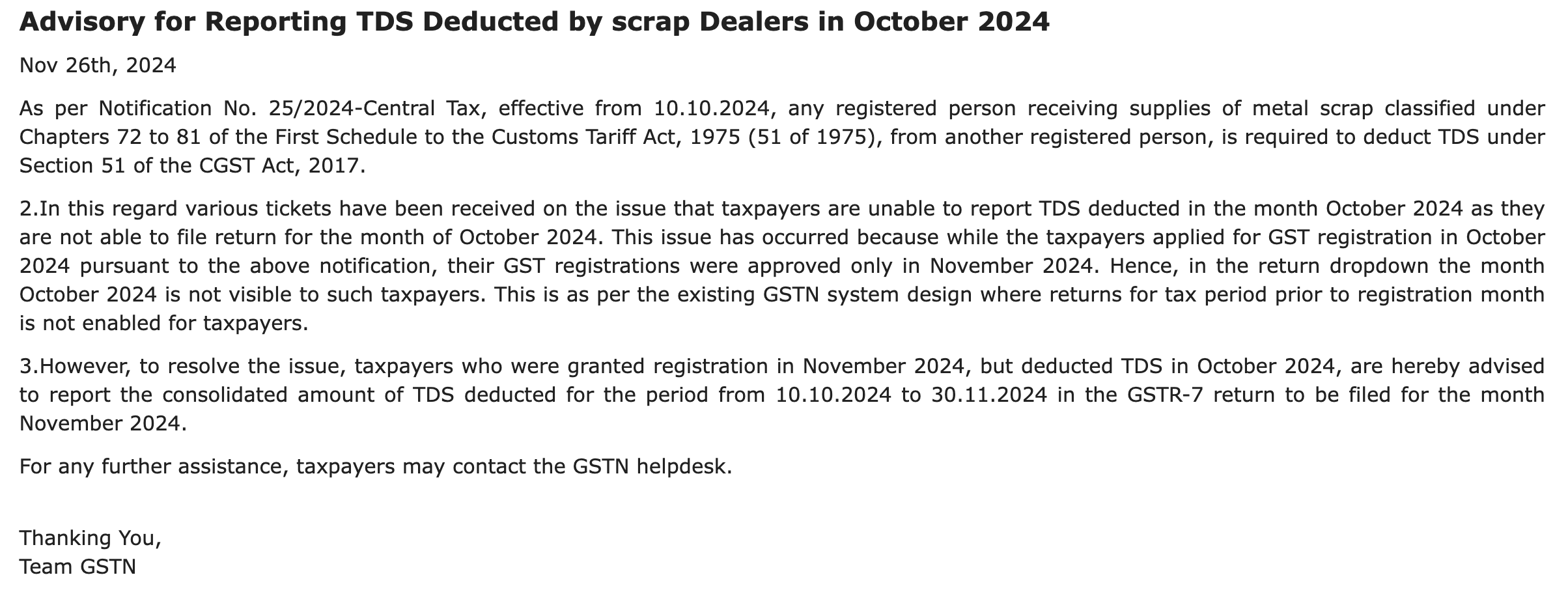

Effective from October 10, 2024, registered persons receiving metal scrap (classified under Chapters 72 to 81 of the Customs Tariff Act, 1975) are required to deduct TDS under Section 51 of the CGST Act, 2017. However, some taxpayers have encountered difficulties reporting TDS for October 2024 due to delayed GST registration approvals.

Issue Faced by Taxpayers:

- Delayed Registration: Taxpayers who applied for GST registration in October 2024 received approval only in November 2024.

- Dropdown Issue: The October 2024 return period is not visible in the GSTR-7 return dropdown due to system design constraints. Returns cannot be filed for tax periods prior to the month of registration.

Resolution Provided:

To address this, taxpayers are advised to follow these steps:

- Consolidated Reporting:

- Report the total TDS amount deducted between October 10, 2024, and November 30, 2024 in the GSTR-7 return for November 2024.

- GSTR-7 Filing:

- Ensure accurate reporting of the consolidated TDS amount to avoid discrepancies in future filings.

Visit www.cagurujiclasses.com for practical courses

Disclaimer:-

The opinions presented are exclusively those of the author and CA Guruji Classes. The material in this piece is intended purely for informational purposes and for individual, non-commercial consumption. It does not constitute expert guidance or an endorsement by any organization. The author, the organization, and its associates are not liable for any form of loss or harm resulting from the information in this article, nor for any decisions made based on it. Furthermore, no segment of this article or newsletter should be employed for any intention unless granted in written form, and we maintain the legal right to address any unauthorized utilization of our article or newsletter.