New Table 12 for GSTR-1, GSTR-1 filing New advisory to report mandatory HSN from Jan 2025 return

The Goods and Services Tax Network (GSTN) has announced the implementation of Phase-III of the mandatory mentioning of HSN codes in GSTR-1 and GSTR-1A. This marks a significant step toward improving the accuracy and efficiency of GST compliance. The changes will be effective from the return period starting January 2025.

Click here to read full Advisory

Key Updates in Phase-III

- Mandatory Drop-Down Selection for HSN Codes:

- Manual entry of HSN codes has been discontinued.

- Taxpayers must select the correct HSN codes from a pre-defined drop-down menu in Table 12 of GSTR-1 and GSTR-1A.

- Bifurcation of Table 12:

- New Tabs Introduced:

- B2B Supplies Tab: For business-to-business transactions.

- B2C Supplies Tab: For business-to-consumer transactions.

- This bifurcation ensures separate reporting of supplies, enhancing data accuracy.

- New Tabs Introduced:

- Validation Mechanism:

- Supply Value Validation: Ensures the reported values of supplies match the respective tax amounts.

- Tax Amount Validation: Verifies that tax values align with supply values.

- During the initial implementation period, validations will operate in “warning mode,” meaning non-compliance will not block return filing.

Benefits of the New System

- Improved Data Accuracy:

- The drop-down selection minimizes errors in HSN code reporting.

- Segregating B2B and B2C transactions simplifies tax analysis and audits.

- Streamlined Compliance:

- Automatic validations guide taxpayers in entering accurate supply and tax values.

- Enhanced Efficiency:

- Pre-defined options reduce the time spent on manual data entry.

Step-by-Step Process for Using the Updated Table 12

Access GSTR-1 or GSTR-1A:

- Login to the GST Portal and navigate to the respective return.

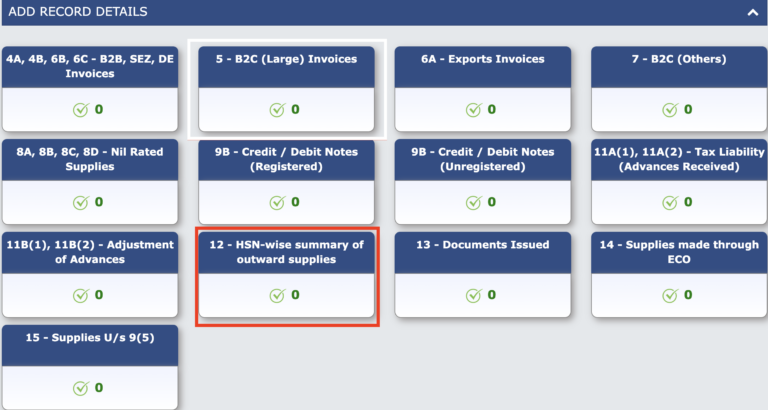

Navigate to Table 12:

- Access the bifurcated tabs for B2B and B2C supplies.

Select HSN Codes:

- Use the drop-down menu to select the appropriate HSN code for each transaction.

Enter Supply and Tax Values:

- Input supply and tax amounts for each transaction.

- Review any warnings generated by the validation mechanism.

Submit the Return:

- Submit and file GSTR-1 or GSTR-1A after verifying all details.

Transition Period and Advisory

- During the initial implementation phase, validation warnings will not block return filing.

- Taxpayers are encouraged to comply with the new system proactively to avoid discrepancies in future audits.

- For detailed guidelines, refer to the official advisory.

Conclusion

The implementation of Phase-III for mandatory HSN code reporting in GSTR-1 and GSTR-1A is a significant move toward streamlining GST compliance. Taxpayers are advised to familiarize themselves with the updated system and ensure timely adherence to the new requirements.

Visit www.cagurujiclasses.com for practical courses

Disclaimer:-

The opinions presented are exclusively those of the author and CA Guruji Classes. The material in this piece is intended purely for informational purposes and for individual, non-commercial consumption. It does not constitute expert guidance or an endorsement by any organization. The author, the organization, and its associates are not liable for any form of loss or harm resulting from the information in this article, nor for any decisions made based on it. Furthermore, no segment of this article or newsletter should be employed for any intention unless granted in written form, and we maintain the legal right to address any unauthorized utilization of our article or newsletter.